Benefits of offering Multiple Payment Options in eCommerce

Something I get asked everyday: How will additional payment methods help my business? Exploring some of the many benefits of offering multiple payments.

In today's fast-paced world, the importance of offering multiple payment options for eCommerce cannot be overstated. With more and more people shopping online, it's important for eCommerce businesses to provide a convenient and secure way for customers to pay for their purchases. Offering multiple payment options can have a significant impact on customer acquisition, conversion rate, frequency, and average order value. In this article, I'll explore these benefits in greater detail.

Improved Customer Acquisition

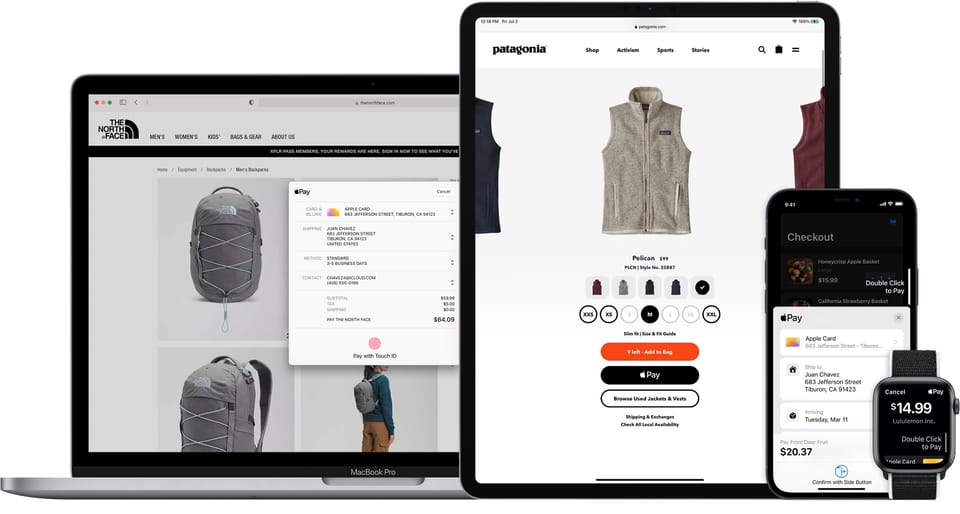

Offering multiple payment options can improve customer acquisition by making it easier for potential customers to shop with you. When you provide customers with a variety of payment options, they're more likely to choose your eCommerce store over a competitor that only offers a few payment methods. This is because customers have different preferences when it comes to payment options. Some prefer to pay with credit cards, while others prefer to use digital wallets like PayPal, Apple Pay, or Google Pay. By offering multiple payment options, you're catering to a wider range of customer preferences, which can lead to increased customer acquisition.

This occurs at all stages of the eCommerce funnel and can be leveraged with footer icons, site ribbons, even promotions and tiles on the respective payment methods shop directory.

Increased Conversion Rate

Conversion rate refers to the percentage of visitors to your eCommerce store who make a purchase or convert. When you offer multiple payment options, you make it easier for customers to complete their transactions. This often leads to an increased conversion rate and subsequently, a decreased bounce rate.

Customers may abandon their shopping carts if they don't see a payment option that they're comfortable with. By offering multiple payment options, you reduce the chances of this happening. This means that more customers will be able to complete their transactions, which can lead to increased sales and revenue.

One key reason for this involves trust and confidence in the risk level associated by using a known payment method with consumer protections or guarantees. I hear that about PayPal very often. Another is economical, as it may be more financially advantageous to split a payment into multiple payments farther away from payroll periods or when budgeting is required.

Higher Frequency of Purchase

When customers have a positive experience shopping with you, they're more likely to come back and make additional purchases. By offering multiple payment options, you can provide a more convenient and positive shopping experience for your customers. This can lead to a higher frequency of purchase, a key driver of growth. Customers may also be more likely to recommend your eCommerce store to others if they have a positive experience. This can lead to additional customer acquisition and increased revenue.

Increased Average Order Value

Offering multiple payment options can also lead to an increased average order value. This is because customers may be more likely to make larger purchases if they have the option to pay over time with a payment plan or through a credit line. Additionally, some payment options offer discounts or incentives for using them. Some credit cards offer cashback or rewards points for purchases. By offering these payment options, you can incentivise customers to make larger purchases, which can increase your average order value.

We see this with different credit card scheme types which could also be a lever to grow AOVs.

Offering multiple payment options for eCommerce almost always has a positive and significant impact on customer acquisition, conversion rate, frequency of purchase, and average order value. By catering to a wide range of customer preferences, you can provide a more convenient and positive shopping experience for your customers. This can lead to increased sales, revenue, and customer loyalty. If you're not already offering multiple payment options for your eCommerce store, it's time to consider doing so.

The easiest way to dial up additional payment methods is through payment orchestration where you become the conductor and can turn on or turn off, set sophisticated rules or even router transactions through lower cost acquiring rails.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of eCommerce payment solutions at Commonwealth Bank and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers, as well as Head of Digital at Blue Illusion. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.