Consultation Topics

Mike Fowler is a payments and merchant acquiring veteran, senior leader & growth strategist for some of Australia's best known brands.

As an SME with more than twenty years of experience in and around payments, Mike Fowler routinely writes about, discusses and consults across key pillars and topics around payments and commerce. With a diverse range of experience related to merchant services and acquiring, retail & eCommerce, integration & implementation, trends, and insights.

Mike Fowler is available for trade events, conferences, panel discussion & moderation, and private consulting in and around these topics:

Payment Systems and Infrastructure

- Understanding the Basics of Card Networks in Australia

- Visa, MasterCard, Amex, EFTPOS

- How Direct Debits and Wire Transfers Work in Australia

- The Role of the SWIFT Network in Australian International Payments

- Real-Time Payments in Australia

- The Impact of the New Payments Platform (NPP)

- Comparing Payment Systems in Australia

- Direct Debits vs. Wire Transfers vs. Real-Time Payments

- The Evolution of Payment Infrastructure

- How Payment Processing Works Behind the Scenes

- The Impact of Fast Payments on Payment Systems

- Payment System Innovations in Australia

- The Future of Payment Infrastructure in Australia

- Trends and Insights

Digital and Mobile Payments

- How Mobile Wallets are Revolutionising Payments in Australia

- Apple Pay, Google Pay, Samsung Pay

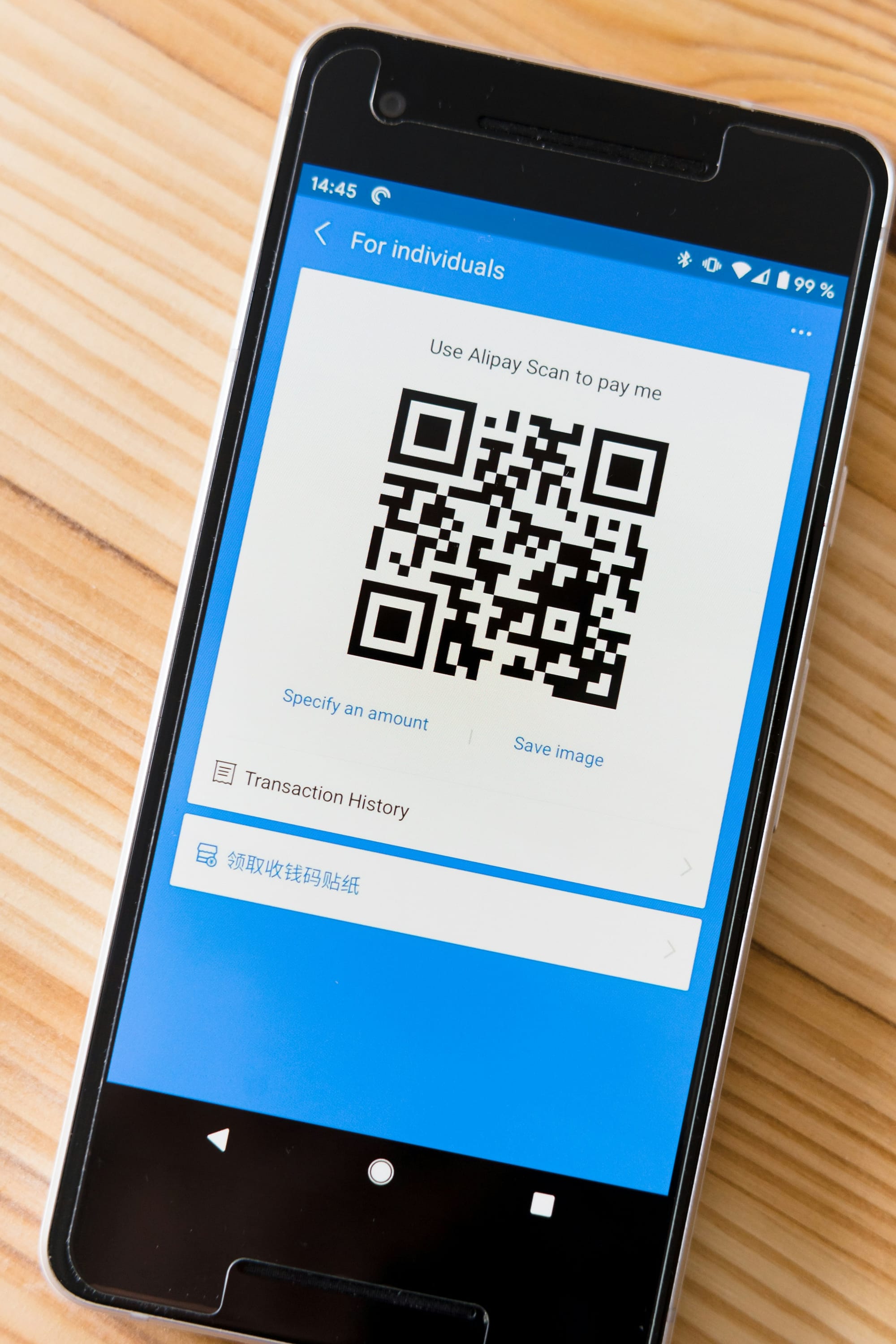

- The Rise of QR Code Payments

- NFC Payments in Australia: Technology, Benefits, and Adoption

- Cryptocurrency Payments in Australia

- The Future of Digital Transactions?

- A Guide to Contactless Payments in Australia

- Digital Wallets in Australia

- Digital Wallets: Security Features

- Digital Wallets: Consumer Adoption

- The Impact of Mobile Payments on E-Commerce

- Comparing Digital Payment Solutions

- PayPal, Alipay, WeChat Pay, and More

- How Blockchain Technology is Shaping the Future of Payments

- Cryptocurrency in Australia

- Cryptocurrency: Opportunities and Challenges

Payment Gateways and Processors

- How Payment Gateways Work

- Stripe, PayPal, and Square

- Choosing the Right Payment Processor for Your Business in Australia

- Understanding Merchant Services

- Role in Payments in Australia

- The Business of Payment Processing in Australia: Key Players and Trends

- Payment Gateway Integration in Australia: Best Practices for Developers

- A Deep Dive into Worldpay, Fiserv, and Adyen in the Australian Market

- How Payment Gateways Ensure Transaction Security in Australia

- The Evolution of Online Payment Gateways in Australia

- Emerging Payment Processors in Australia: New Players in the Market

- Comparing Payment Gateways in Australia

- Features, Fees, and Performance

Regulatory and Compliance Issues

- PCI DSS Compliance in Australia: A Guide for Businesses

- Understanding AML and KYC Regulations in Payments in Australia

- The Impact of PSD2 and Open Banking on Australian Payment Systems

- Regulation E and Its Australian Equivalent

- Navigating Global Payment Regulations from an Australian Perspective

- How to Stay Compliant with Payment Security Standards in Australia

- The Role of Regulatory Bodies in Australian Payment Systems

- Emerging Regulations in the Australian Payment Industry

- The Cost of Non-Compliance in Payment Processing in Australia

- Future Trends in Payment Regulation and Compliance in Australia

Fraud Prevention and Security

- Top Fraud Detection Technologies in Payment Processing in Australia

- How Tokenisation Enhances Payment Security

- Encryption Methods for Securing Transaction Data

- EMV Technology in Australia

- Reducing Fraud with Chip Cards

- Biometric Authentication in Payments: Pros and Cons

- The Role of AI and Machine Learning in Fraud Prevention

- Common Payment Frauds and How to Prevent Them

- Building a Secure Payment System: Best Practices

- Case Studies of Payment Fraud and Their Lessons

- The Future of Payment Security: Trends and Innovations

Innovation and Emerging Technologies

- How Blockchain and DLT are Disrupting Payments

- Artificial Intelligence in Payment Processing: Use Cases

- The Role of IoT in the Future of Payments

- Biometric Payment Methods: Fingerprint, Facial Recognition, and More

- How Open Banking is Changing the Payment Landscape

- Innovations in Cross-Border Payments: Faster and Cheaper Solutions

- The Rise of Decentralised Finance (DeFi) and Its Impact on Payments

- Voice-Activated Payments (IVR+): The Next Frontier?

- How Augmented Reality (AR) is Shaping In-Store Payments

- Future Payment Technologies: What to Expect in the Next Decade

User Experience and Customer Trends

- Designing a Seamless Payment Experience for Customers

- The Impact of User Experience on Payment Conversion Rates

- Trends in Consumer Payment Preferences

- The Growth of Buy Now, Pay Later (BNPL) Services

- Integrating Payments with Loyalty and Rewards Programmes

- How Contactless Payments are Changing Retail

- Creating an Omnichannel Payment Experience

- The Role of Social Media in Payment Trends

- Understanding Consumer Behaviour in Digital Payments

- The Future of E-Commerce Payments: Trends and Predictions

Cross-Border and International Payments

- Currency Conversion in International Payments: Challenges and Solutions

- The Technology Behind International Remittances

- Regulatory Challenges in Cross-Border Payments

- How Global Payment Networks Like Alipay and WeChat Pay Operate

- The Future of Cross-Border E-Commerce Payments

- Case Studies: Successful Cross-Border Payment Solutions

- Understanding Exchange Rates in International Transactions

- The Impact of Blockchain on Cross-Border Payments

- How to Optimise Cross-Border Payment Processing

- Emerging Markets and Their Payment Systems Impacting Australia

Merchant and Consumer Behaviour

- How E-Commerce Trends Affect Payment Preferences

- The Impact of Changing Retail Landscapes on Payment Systems

- Consumer Behaviour Insights: Choosing Payment Methods

- How Businesses Can Adapt to Changing Payment Trends

- The Role of Payment Flexibility in Customer Satisfaction

- Personalization in Payment Processing: What Consumers Expect

- How Subscription Models are Changing Payment Dynamics

- The Rise of Peer-to-Peer Payments and Their Impact on Retail

- Understanding the Psychology Behind Payment Choices

- Case Studies: How Payment Innovation Drives Consumer Engagement

Business Models and Economics of Payments

- How Interchange Fees Work and Their Impact on Merchants

- Revenue Models in the Payment Processing Industry

- Strategies for Managing Payment Processing Costs

- The Economics of Payment Gateways and Processors

- How Businesses Can Benefit from Payment Data Analytics

- The Role of Partnerships in the Payment Ecosystem

- Understanding the Cost Structure of Payment Services

- The Future of Payment Economics: Trends and Predictions

- The Impact of Emerging Technologies on Payment Business Models

- How Payment Innovations Can Drive Business Growth

Mike Fowler | Consultation Topics

About Mike Fowler

Mike Fowler is a payments and merchant acquiring veteran, senior leader & growth strategist for some of Australia's best known brands. Technical Transaction Specialist, Corporate & Institutional at National Australia Bank (NAB). Formerly at Afterpay as Director, Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.