Merchant Choice Routing: What is It?

Merchant Choice Routing (MCR) enables merchants to choose the most cost-effective routing path for payment transactions, potentially lowering their transaction processing costs.

Merchant Choice Routing (MCR), also known as Least Cost Routing (LCR), is a process that enables a merchant to choose the most cost-effective routing path for payment transactions. It's especially relevant for transactions involving debit cards issued under multiple networks (such as Visa, Mastercard, or other scheme networks). By choosing the least expensive network for each transaction, a merchant can potentially lower their transaction processing costs.

MCR can be applied to both card-present and card-not-present transactions:

Card-Present Transactions

These are transactions where the physical card is used at a point-of-sale (POS) terminal, such as in-store purchases. In this case, a merchant's POS terminal reads the card information and communicates with the acquirer or payment processor to determine the available networks for processing the transaction. The system then selects the least expensive network based on the predetermined criteria set by the merchant, such as fees or interchange rates.

To enable MCR for card-present transactions, merchants need to have compatible POS terminals that support multiple networks and can dynamically route transactions. These terminals should also be configured correctly to prioritise the networks based on the merchant's preferences.

Card-Not-Present Transactions

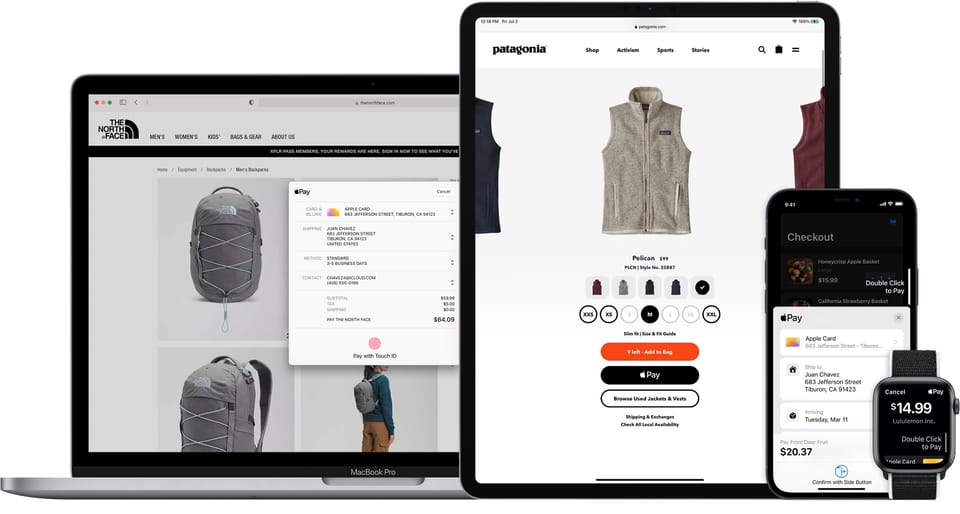

These are transactions where the cardholder is not physically present, such as online or phone purchases. For card-not-present transactions, the merchant's payment gateway or e-commerce platform plays a crucial role in determining the routing path.

To implement MCR for card-not-present transactions, merchants need to work with their payment gateway provider or e-commerce platform to ensure that the routing logic is in place. This may involve integrating APIs or other tools such as a payment orchestration layer that can enable the selection of the least expensive network based on the merchant's preferences.

It's essential for merchants to regularly review and update their routing preferences, as network fees and interchange rates may change over time. By consistently choosing the least expensive routing path, merchants can lower their transaction processing costs and improve their overall profitability.

Opportunities and Challenges

While MCR provides significant opportunities for merchants to reduce their transaction processing costs, there are also challenges that need to be considered.

Opportunities

Cost Savings: The primary benefit of implementing MCR is the potential for cost savings. By routing transactions through the least expensive network, merchants can reduce the fees they pay for each transaction. These savings can be particularly significant for high-volume merchants, as even small reductions in per-transaction fees can lead to substantial savings over time.

Increased Competition: MCR fosters competition among payment networks, as merchants are more likely to select networks that offer lower fees and better service. This competition can lead to overall improvements in the payment processing landscape, with networks striving to provide better offerings to attract merchants.

Flexibility and Control: MCR gives merchants more control over their transaction processing, allowing them to select networks based on their preferences and business needs. This can lead to more tailored payment processing solutions that better align with a merchant's goals and objectives.

Challenges

Technology and Integration: Implementing MCR requires compatible POS terminals for card-present transactions or payment gateway integrations for card-not-present transactions. Merchants may need to invest in new hardware or software, and they may also need to work closely with their payment processor or gateway provider to ensure the correct routing logic is in place.

Monitoring and Maintenance: As network fees and interchange rates change over time, merchants need to consistently review and update their routing preferences. This can be time-consuming and may require ongoing attention to ensure that the least expensive routing path is consistently selected.

Regulatory Considerations: While MCR exists in Australia under legislation, in other regions there may be regulatory restrictions or requirements related to MCR. Merchants should be aware of any applicable regulations and ensure that their MCR practices comply with local laws.

Merchant Choice Routing offers a valuable opportunity for merchants to reduce their transaction processing costs and take greater control over their payment processing. However, implementing MCR requires careful consideration of the associated challenges, including technology investments, ongoing monitoring, and regulatory compliance.

Summary

By understanding the benefits and drawbacks of MCR, merchants can make informed decisions about whether to adopt this approach and how to best implement it in their businesses. With the right strategy in place, MCR can lead to significant cost savings and improvements in payment processing efficiency, ultimately contributing to a merchant's overall success.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of payment solutions at National Australia Bank and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.