PayTo: A New Payment Revolution for Businesses

Account to account payments are on every businesses radar. Why? Woolworths has now announced its plans to shift payment processing to PayTo using the New Payments Platform (NPP), Australia's real-time payments system. This is going mainstream. Right now.

Account to account payments are on every businesses radar. Why?

Woolworths has now announced its plans to shift payment processing to PayTo using the New Payments Platform (NPP), Australia's real-time payments system. Aiming to replace higher cost card network fees. They believe that this transition will not only lower the risk of fraud, but also encourage customers to utilise a digital wallet within their rewards program.

At this scale, account to account (A2A) transactions will become the norm.

What exactly are A2A transactions and PayTo?

PayTo is a payment system that is being rolled out in Australia. It is a faster, easier, and more secure way to make payments than traditional methods like direct debits or bank transfers.

For businesses, PayTo offers a number of advantages, including:

- Real-time payments: PayTo payments are processed instantly, which means that your customers will receive the money immediately. This can help to improve customer satisfaction and reduce the risk of payment disputes.

- Reduced fraud: PayTo payments are processed through the New Payments Platform (NPP), which is a secure and reliable payment network. This helps to reduce the risk of fraud and protect your business from financial losses.

- Automated payments: PayTo can be used to set up automated payments for things like recurring subscriptions or bills. This can save you time and hassle, and it ensures that your payments are always made on time.

- Improved customer data: PayTo payments can provide you with more detailed customer data. This can help you to improve your customer service and marketing efforts. Combine this with rewards and loyalty and you have a closed loop.

The New Payments Platform (NPP) is the underlying technology that powers PayTo. The NPP is a fast, secure, and reliable payment network that is used by all major banks and financial institutions in Australia. This means that PayTo payments can be processed quickly and easily, regardless of which bank the sender and recipient use.

If you are a business owner, PayTo is a payment system that you should consider using. It offers a number of advantages that can help you to improve your business operations and save money.

Here are some specific examples of how PayTo can be used by businesses:

- Recurring payments: PayTo can be used to set up recurring payments for things like subscriptions, memberships, or utility bills. This can save businesses time and hassle, and it ensures that payments are always made on time.

- One-off payments: PayTo can also be used to make one-off payments to customers or suppliers. This is a convenient way to pay for goods or services, and it is especially useful if you do not have the recipient's bank account details.

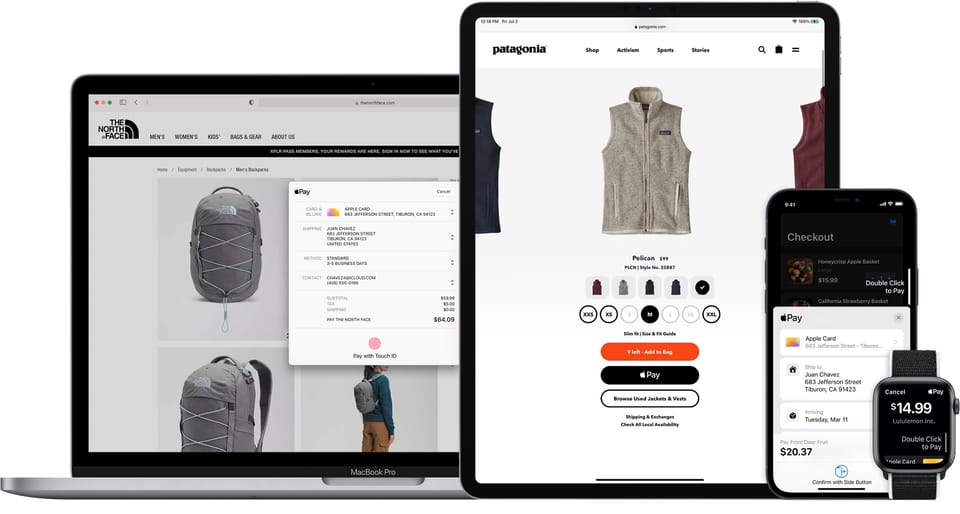

- Funding digital wallets: PayTo can also be used to fund digital wallets. This allows businesses to accept payments from customers using their mobile phones and other mobile devices.

- Payroll: PayTo can be used to process payroll payments to employees. This can help businesses to save time and money, and it can also improve the accuracy of payroll payments.

PayTo is a powerful new payment system that has the potential to change the way businesses make payments. It is faster, easier, and more secure than traditional payment methods, and it is set to become a major player in the Australian payments landscape.

If you are interested in learning more about PayTo, you can visit the NPP website: https://nppa.com.au/payto/.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of payment solutions at National Australia Bank and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.