Successful Payment Strategies for FY24

As the financial year 2024 approaches, eCommerce brands must focus on payment methods, payment infrastructure, and data-rich tools to drive growth and improve the customer experience. In order to achieve this, brands should offer a variety of payment methods, streamline the payment process, …

It's time to start thinking about financial year 2024.

If you are taking payments on or offline, you should be thinking about what that looks like in todays climate. With the right forward planning, you can improve the overall customer experience and drive growth.

Focus on payment methods, payment infrastructure and tools that allow you to be data rich and agile to optimise commercial results:

Offer a Variety of Payment Methods

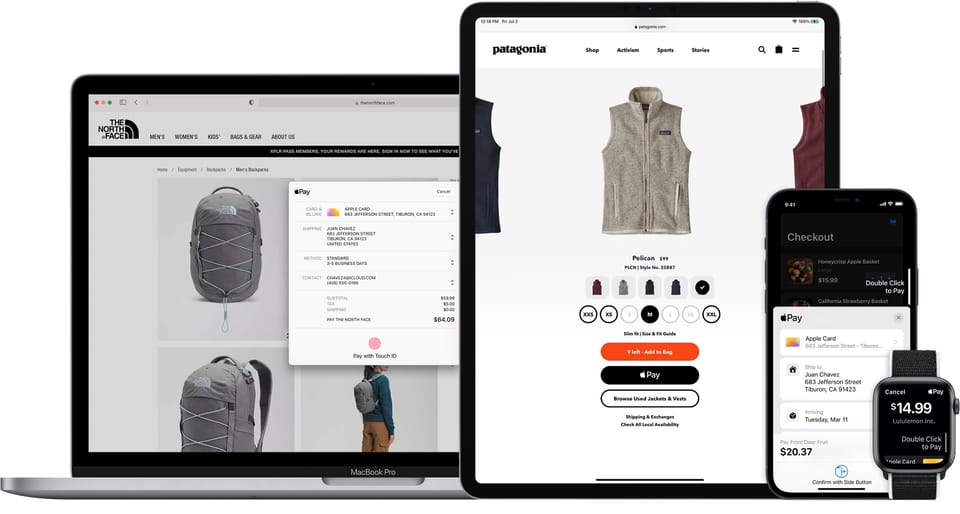

eCommerce brands should offer a variety of payment methods to their customers, including credit and debit cards, PayPal, Apple Pay, Google Pay, and other local payment options such as Afterpay and Zip BNPL. This can help to increase conversion rates and reduce cart abandonment rates.

Optimise Payment Processes

Streamlining the payment process and reducing friction can lead to improved customer experiences and higher conversion rates. eCommerce brands should optimise the checkout process, minimise the number of steps and input boxes required to complete a purchase, and ensure that the checkout process is mobile-friendly.

Implement Strong Security Measures

eCommerce brands should implement strong security measures to protect their customers' sensitive information and build trust. This includes using SSL encryption, complying with PCI DSS regulations, and implementing fraud detection and prevention measures, fraud detection, and 3D Secure 2.0.

3D Secure 2.0

The latest version of the 3D Secure authentication protocol used in online card payments. It is an industry-wide standard developed by a consortium of major payment networks, including Mastercard, Visa, American Express, Discover, and JCB.

3D Secure 2.0 provides enhanced security features compared to its predecessor, 3D Secure 1.0, while also improving the user experience. The key features of 3D Secure 2.0 include:

- Risk-Based Authentication: 3D Secure 2.0 allows issuers to assess the risk of a transaction based on a range of data, including device information, transaction history, and behavioral biometrics, among others. This allows issuers to only require authentication for high-risk transactions, reducing friction for low-risk transactions.

- Frictionless Flow: 3D Secure 2.0 provides a seamless checkout experience for customers, allowing transactions to be authenticated in the background without requiring the customer to enter a password or other authentication information.

- Mobile-Friendly: 3D Secure 2.0 is designed to work well on mobile devices, with support for biometric authentication, such as fingerprint or facial recognition, making it easier for customers to authenticate transactions on their mobile devices.

- Strong Customer Authentication: 3D Secure 2.0 provides a more robust authentication process, requiring multiple forms of authentication, including two-factor authentication, to ensure that the person making the transaction is the rightful owner of the card.

By providing enhanced security features and improving the user experience, 3D Secure 2.0 aims to reduce fraud and increase customer confidence in online transactions.

Leverage Data Analytics

Analysing customer data can provide insights into customer preferences and behaviour, allowing eCommerce brands to optimise their payments strategy. Brands can use data analytics to identify the most popular payment methods and optimise the checkout process accordingly. Even utilising advanced rules engines to reduce costs in payment type routing.

Partner with Payment Providers

eCommerce brands can partner with payment providers to access advanced payment technology and expertise. Payment providers can offer support for managing payments, reducing fraud, and increasing conversions.

Scale Payments Infrastructure

As eCommerce brands grow, they should consider scaling their payments infrastructure to meet increasing demand. This may include investing in more advanced payment technology, implementing multiple payment gateways, and expanding their global payments capabilities.

By incorporating these key elements into their payments strategy, eCommerce brands can optimise commercial results and drive growth while delivering exceptional customer experiences.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of payment solutions at Commonwealth Bank and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers, as well as Head of Digital at Blue Illusion. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.