The Evolving Retail Payments Landscape

Consumer preference for contactless payments and mobile wallets is leading to declining cash usage. The NPP continues to grow ... what is this NPP and what are some of it's considerations?

Electronic payment methods are becoming the norm in Australia. Consumer preference for contactless payments and mobile wallets is leading to declining cash usage. The NPP continues to grow, and new participants and technologies are widening the payment options available to consumers and businesses.

Let's look at the RBA annual payments report.

The lowdown of Australia's payment trends

- The share of electronic transactions has continued to increase, while cash and cheques are used less frequently.

- New technologies and participants in the payments ecosystem are widening the payment options available to consumers and businesses.

- Australians made around 650 electronic transactions per person on average in 2021/22, compared to about 300 a decade earlier.

- Debit and credit cards are the most commonly used retail payment methods in Australia, while direct debits and credit transfers processed through the direct entry system account for the bulk of non-cash retail payments.

- Growth in debit card use accelerated during the pandemic, with spending on debit cards (by value) around 40% higher in the first half of 2022 than in the second half of 2019.

- The share of retail sales conducted online increased sharply during periods of pandemic-related lockdowns, and remains higher than it was prior to the pandemic.

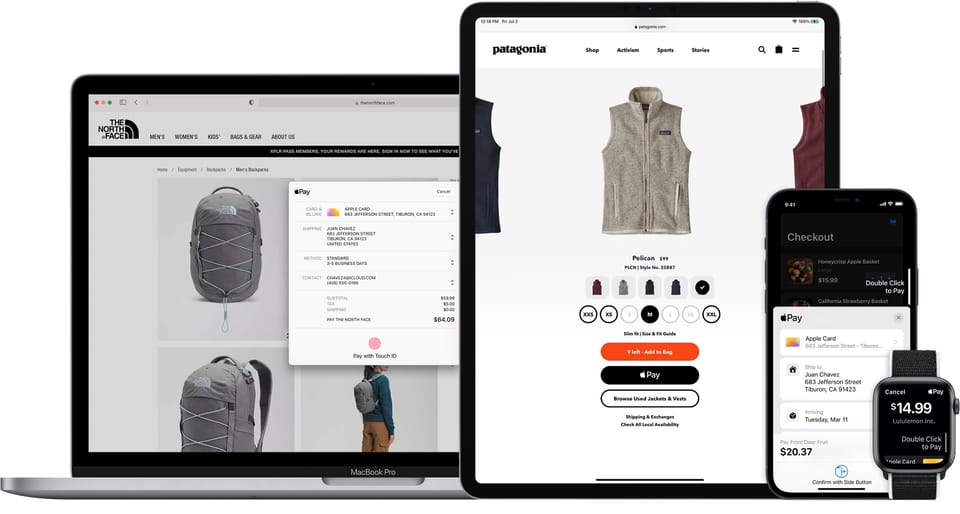

- The share of debit and credit card transactions made via mobile wallets more than doubled between the March quarter of 2020 and the March quarter of 2022, from 10% to 25%.

- The value of BNPL transactions increased by around 37% in 2021/22 to $16 billion, equivalent to around 2% of Australian card purchases.

- Cash is used less often for payments but is still important for some people. Cash acceptance by retailers with a physical presence fell to 94% in June 2022, from 99% in February 2020.

- The NPP enables consumers, businesses, and government agencies to make real-time, data-rich payments 24 hours a day, every day of the year and processes more than 25% of the total number of account-to-account payments.

Let's unpack a few of the new trends

New Payments Platform (NPP)

NPP stands for New Payments Platform, which is a fast account-to-account payments system launched in Australia in 2018. It enables consumers, businesses, and government agencies to make real-time, data-rich payments 24 hours a day, every day of the year. Over 100 payment providers, including some non-bank payment service providers, now offer NPP services to almost 90 million customer accounts. The NPP processes more than 25% of the total number of account-to-account payments. The NPP's PayID service also allows payments to be addressed to a payee’s registered mobile phone number, email address or Australian Business Number rather than to a BSB and account number.

NPP underpins various payment services including PayID and Osko.

PayTo

PayTo is a payment service introduced in Australia that enables consumers to make payments using their mobile number or email address instead of a BSB and account number. PayTo can be used as an alternative payment method for in-person or online transactions, and to streamline certain business payments such as payroll. The service went live in July 2022, and while consumer uptake will take time, banks are now starting to enable the service for their customer accounts. By addressing a payment to a PayID, the payer can check that they are sending the payment to the intended recipient before completing the transaction.

PayID

PayID is a service that enables consumers to make payments using their mobile number or email address as an alternative to using a BSB and account number. The service is part of the New Payments Platform and allows consumers to check the account name of the payee prior to completing the transaction, which can help avoid mistaken payments and some types of scams. The NPP's PayID service now has around 11 million registered PayIDs in Australia, up from around 8 million a year earlier. Although the share of payments made using PayIDs is increasing, the majority of NPP payments are still addressed to BSB and account numbers.

Account-to-Account (A2A)

A2A stands for "account-to-account", which is a type of electronic payment where funds are transferred directly between two bank accounts. The New Payments Platform (NPP) in Australia is an A2A payments system that enables real-time electronic payments and transfers 24 hours a day, every day of the year, using a PayID or BSB and account number to address the payment. A2A payments are typically faster and less expensive than other forms of electronic payments like card payments or BPAY.

The New Payments Platform (NPP), along with services like PayTo and PayID, are designed to address several key areas in the payment process:

- Time: The NPP is built for speed, enabling near real-time fund transfers between banks, 24/7. This is a significant improvement over traditional payment methods, which could take several days for funds to clear, particularly for transactions across different banks.

- Cost: By facilitating direct account-to-account transactions, the NPP may help to lower transaction costs by avoiding the fees associated with traditional card networks.

- Convenience: The NPP enables more convenience in payments. With PayID, for example, users can link their bank account to an easily remembered identifier such as a mobile phone number or an email address. This makes it easier to give out payment details and reduces the risk of errors compared to using traditional bank account numbers. PayTo, on the other hand, was intended to simplify the process of setting up and managing direct debits for recurring payments.

- Data-rich payments: The NPP is designed to carry more data with each transaction. This can include detailed descriptions or even documents, which is useful for both businesses and individuals.

- Improved Cash Flow: Services like PayTo can provide businesses with real-time visibility over successful and unsuccessful payments. Instead of taking days for a direct debit to clear, payments via PayTo on the NPP would clear almost instantly. This could potentially improve cash flow for businesses and make it easier to manage finances.

- Security: With features like PayID, users don't have to share their bank account details, which adds a layer of security to transactions.

Note: Success and impact of these services depend on many factors, including adoption rates, technical infrastructure, and regulatory considerations.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of payment solutions at National Australia Bank and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.