The Future of Fraud Prevention in the Payments Industry

AI & machine learning go hand-in-hand with payments to reduce fraud and recognise patterns that optimise authorisation rates and reduce declines. What is it and what are some techniques that are being leveraged?

As the payments industry continues to evolve, so do the methods employed by fraudsters to exploit vulnerabilities. In today's digital landscape, merchants and consumers alike face an ever-increasing risk of fraudulent transactions. To combat this growing threat, we must embrace cutting-edge technologies, particularly artificial intelligence (AI) and machine learning (ML), to stay ahead of the curve and protect our respective stakeholders.

Evolving Fraud Landscape: A Cat-and -Mouse Game

Fraudsters are constantly adapting their tactics, exploiting advancements in technology to infiltrate systems and steal sensitive information. Traditional fraud prevention methods, such as static rules and signature- based detection, are becoming less effective as fraudsters devise more sophisticated techniques to exploit digital systems. To stay ahead of these evolving threats, we need to adopt more dynamic and intelligent approaches to fraud prevention.

AI and Machine Learning: The New Frontier of Fraud Detection

AI and ML are transforming the fraud prevention landscape, offering a powerful arsenal of tools to detect and prevent fraudulent transactions. These technologies can analyse vast amounts of data, including transaction patterns, device fingerprinting, and behavioural anomalies, to identify and flag suspicious activity. Unlike traditional methods that rely on predefined rules, AI and ML can continuously adapt to new fraud patterns, providing real-time protection against ever-evolving threats.

Key Trends and Innovations in Fraud Prevention Technologies

The payments industry is witnessing a surge in the development and adoption of innovative fraud prevention technologies, driven by advancements in AI and ML.

These technologies include:

- Adaptive Authentication: Dynamically adjusting authentication requirements based on risk assessment, providing a more seamless and secure customer experience.

- Behavioural Analytics: Analysing user behaviour patterns, such as device usage, location, and transaction history, to identify anomalies and potential fraud.

- Machine Learning Fraud Modelling: Utilising machine learning algorithms to identify complex fraud patterns and predict future fraudulent activity.

- Real-Time Fraud Detection: Analysing transactions in real-time, flagging suspicious activity, and taking appropriate actions, such as requesting additional authentication or declining the transaction.

Role of AI and Machine Learning in Detecting and Preventing Fraud

AI and ML play a pivotal role in detecting and preventing fraud by providing several key benefits:

- Enhanced Pattern Recognition: AI and ML algorithms can identify subtle patterns and anomalies in transaction data that might be overlooked by traditional methods.

- Continuous Learning and Adaptation: AI and ML models can continuously learn from new data and adapt to evolving fraud patterns, providing ongoing protection against emerging threats.

- Automated Decision-Making: AI and ML can automate fraud detection and prevention decisions, reducing the time and resources required to manually review transactions.

Strategies for Merchants to Protect Themselves from Fraudulent Transactions

Merchants can adopt a range of strategies to protect themselves from fraudulent transactions, including:

- Implement Strong Authentication: Require strong authentication methods, such as two-factor authentication (2FA), to verify customer identity and prevent unauthorised access.

- Payer authentication (3D Secure): Authenticate customers on the front end, detecting more good requests before you send them for authorisation. This adds an extra layer of fraud prevention while also minimising false declines.

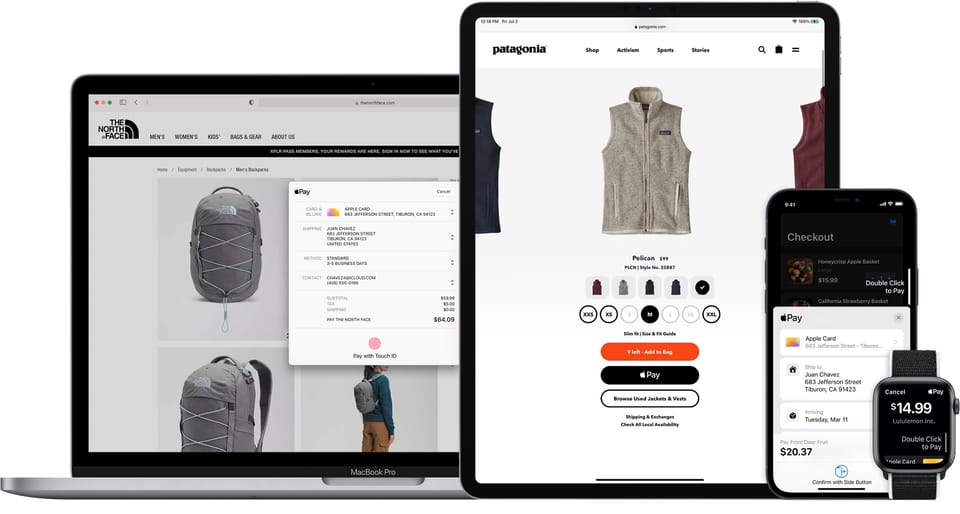

- Utilise Fraud Prevention Tools: Integrate AI and ML-powered fraud prevention tools to analyse transactions and identify suspicious activity in real-time. These tools include Visa’s Decision Manager, Accertify, Riskified, and Forter to name a few.

- Educate Employees: Train employees to recognise and report suspicious activity, ensuring they are aware of the latest fraud trends and techniques.

- Maintain Data Security: Implement robust data security practices, including encryption and access controls, to protect sensitive customer information.

- Monitor and Adapt: Regularly review fraud prevention strategies and adapt them to address new threats and evolving fraud patterns.

Embracing the Future of Fraud Prevention

The future of fraud prevention largely includes the adaptation of Artificial Intelligence and Machine Learning.

Merchants that make fraud prevention a key element in their payment optimisation will reap the benefits in reduced fraud, increased authorisations and reduced decline rates.

By embracing these technologies, businesses can gain a significant advantage in the ongoing battle against fraud, safeguarding the financial transactions of merchants and consumers.

About Mike Fowler

Mike is a payments and eCommerce veteran, senior leader & growth strategist for some of Australia's best known brands. Currently, an Enterprise lead for technical sales/presales at National Australia Bank (NAB), Corporate & Institutional. Formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.