The Power of Tokenization in Omnichannel Payments: Part II

Part II on Tokenization - Harness the power of tokenization to achieve a competitive edge and deliver unparalleled customer experiences.

Second in my series on tokenization and exploring omnichannel implications.

In the rapidly evolving landscape of retail and commerce, businesses are increasingly recognising the significance of adopting omnichannel payment strategies to meet the demands of modern consumers. I’ll delve into the transformative potential of tokenization within the omnichannel framework, focusing on how a single token can reshape customer experiences, enhance loyalty programs, and uplift your data collection.

There are many challenges faced by businesses in providing seamless payment experiences across diverse channels, including online platforms, brick-and-mortar stores, and mobile applications. These challenges often stem from the complexities of handling sensitive payment data securely while ensuring a consistent and convenient customer journey.

Tokenization involves the substitution of sensitive payment information with a unique identifier, known as a token. This token retains no meaningful information about the original data, rendering it useless to potential cyber threats. This inherent security attribute makes tokenization a cornerstone of safe and compliant payment processing.

We described what a token is and why it is secure, reducing risk and fraud in Part I of this series. What else is in it for you and more importantly, your customer?

Omnichannel and the single token

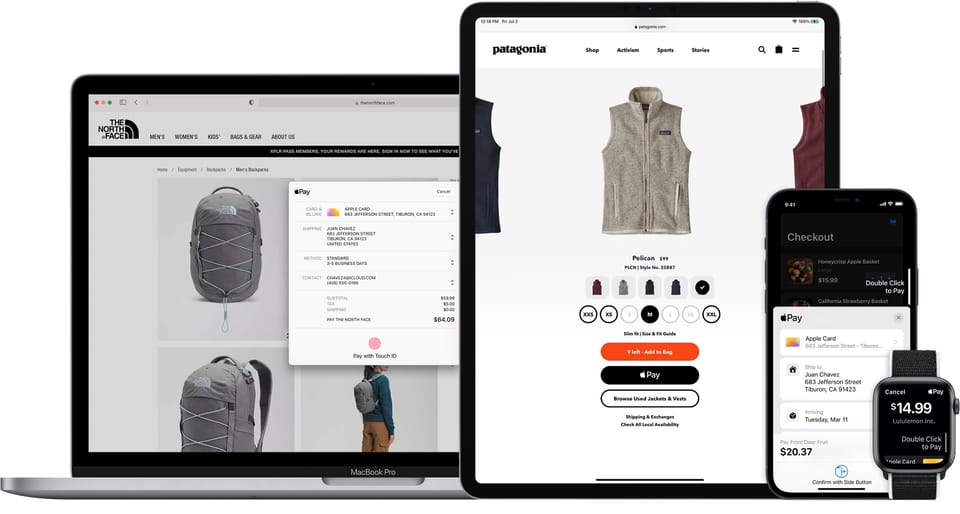

A single token can serve as a universal key to unlock a truly omnichannel experience for customers. This means that whether a customer is making a purchase online, at a physical store, or through a mobile app, they can use the same tokenized credential for payment, eliminating the friction of repeatedly entering payment data. These are all the familiar scenarios like Buy Online Pickup in Store (BOPIS) and Buy Online Return in Store (BORIS) and what is likely to evolve - the reverse. Important to note that we as customers and our own customers don’t see a brand or business through a single channel lens. Most customers see all retail manifestations of brand as one.

By utilising a single token for payment, customer and loyalty identification, businesses can seamlessly integrate rewards and discounts across all channels - even gift cards, a notorious painful aspect for the omnichannel retailer. This not only simplifies the redemption process, it also encourages customer engagement and fosters stronger brand loyalty.

Why would your customers care?

Customers reward brands with their loyalty and patronage when their journey is easiest. In the common delivery of payment capabilities, customers are being penalised with 3 checkout steps on average and more than 25 input boxes. That’s painful. By leveraging tokenization, you not only remove these massive speed humps in the customer journey, but also make shopping across any channel rewarding. … and with a single click to pay.

This would require some thinking around bringing together the checkout stack where you display your payment options with the ability to tokenize those payments and recognise existing customers. A “unified checkout” if you will.

Data collection and personalisation

One of the most compelling aspects of tokenization lies in its potential to revolutionise data collection. A single token can function as a conduit for gathering valuable insights about customer behaviour across various touchpoints. This data enables businesses to tailor their offerings, marketing strategies, and customer interactions, culminating in a more personalised and satisfying experience for each individual.

There is a pivotal role of tokenization in reshaping omnichannel payment strategies. By leveraging a single token for secure transactions, loyalty programs, and data collection, businesses can bridge the gap between different channels, elevate customer loyalty, and glean meaningful insights for continuous improvement. As the business landscape continues to evolve, harnessing the power of tokenization is poised to be a defining factor in achieving a competitive edge and delivering unparalleled customer experiences.

About Mike Fowler

Mike is an eCommerce veteran, senior leader & growth strategist for some of Australia's best known retailers. Currently, a manager of payment solutions at National Australia Bank (NAB) and formerly at Afterpay as Director of Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.