The Rise of Digital Wallets and What's in Store for the Future

Digital wallets offer a faster, safer, and more convenient way to manage your money, both in stores and online. Half the world's population will be using them by 2026. What's next?

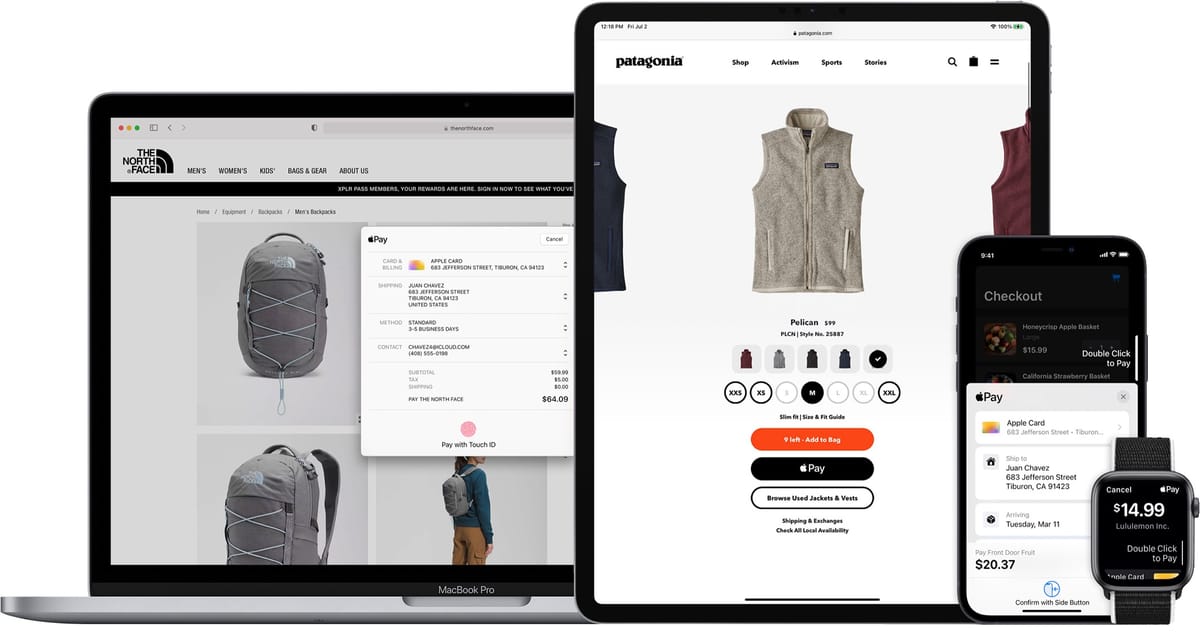

Our wallets, once bursting with cash, cards, and receipts, are getting a digital makeover. The rise of digital wallets like Apple Pay, Google Pay, and Samsung Pay is transforming how we pay for everything from morning coffee to that new gadget online. But what's driving this shift, and what does the future hold for this technology?

Convenience Takes the Wheel

Let's be honest, who hasn't rummaged through their bag or wallet at checkout, desperately searching for the right card? Digital wallets eliminate this frustration. With a simple tap or wave of your phone, you can pay securely, making in-store transactions a breeze. Many wallets even work for online purchases, saving you the hassle of repeatedly entering card details.

Security That Packs a Punch

Gone are the days of swiping cards and exposing personal information. Digital wallets use secure elements on your phone and encryption to safeguard your financial data. Fingerprint or facial recognition adds another layer of security, making them arguably safer than traditional cards.

Beyond Payments: A Loyalty Card Powerhouse

Digital wallets are becoming multi-purpose tools. Many store loyalty cards and membership programs, allowing instant access to your points and rewards at checkout. Imagine never forgetting your discount card again!

A Global Trend, But Local Variations

The digital wallet revolution is sweeping the globe. Experts predict over half the world's population will be using them by 2026. However, the landscape varies by region. While Apple Pay and Google Pay dominate in some areas, Asia has seen the rise of giants like China's Alipay and India's PayTM.

The Future is a Digital Wallet Wonderland

The future of digital wallets is brimming with possibilities. As people become more comfortable with digital transactions, adoption is expected to soar. We can expect wallets to integrate even more features, potentially helping us manage budgets, track spending, or receive personalized deals.

Visa & Mastercard: Partners, Not Foes

While the card schemes recent announcements might raise questions, it's important to remember that digital wallets are not a direct threat. Many wallets, like Apple Pay, utilize scheme networks in the background. The future might see even greater collaboration between these technologies.

Saying that, with the imminent rise of account to account (A2A) transactions, I would expect to see continued dominance of card payments across both in-store and online channels due to accessibility and protections. A2A transaction will displace larger peer-to-peer transactions (rent payments, splitting bills) or for situations where the recipient doesn't have a digital wallet.

Biometric Payments and Authentication

Imagine a world where you can buy that perfect outfit online with just a tap of your finger (or a scan of your face) on your phone. Digital wallets eliminate the need to manually enter lengthy credit card details and shipping information every time you shop online.

Biometric authentication adds an extra layer of security to online transactions with digital wallets. Instead of relying solely on passwords (which can be vulnerable to hacking), you can use your fingerprint, facial recognition, or iris scan to verify your identity. This makes it much harder for unauthorized individuals to gain access to your payment information.

The combination of digital wallets and biometrics is paving the way for a frictionless online payment experience. Not only is it faster and more convenient, but it also reduces the risk of fraud. As technology advances, we can expect even more sophisticated biometric authentication methods to be integrated, further streamlining the online shopping experience.

So, ditch the bulky wallet and embrace the future. Digital wallets offer a faster, safer, and more convenient way to manage your money, both in stores and online. With constant innovation on the horizon, the future of digital wallets is looking bright, secure, and feature-packed.

About Mike Fowler

Mike is a payments and merchant acquiring veteran, senior leader & growth strategist for some of Australia's best known brands. Technical Transaction Specialist, Corporate & Institutional at National Australia Bank (NAB). Formerly at Afterpay as Director, Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.