Account-to-Account Payments: An American's Perspective from Australia

While fintech innovation continues to grow, significant strides are needed to simplify account-to-account payments in the U.S. It's time for the U.S. banking system to catch up and offer the seamless, real-time transactions that are already standard in other parts of the world.

As an American who has lived in Australia for the past 20 years, I’ve had the opportunity to witness firsthand the stark differences between the banking systems in these two countries, especially when it comes to account-to-account payments. In Australia, real-time payments have become the norm, thanks to the New Payments Platform (NPP) and OSKO services, which ensure that funds are transferred almost instantaneously. Even the traditional Bulk Electronic Clearing System (BECS) network can handle same-day transfers using a BSB - directly between banks.

However, sending and receiving money to and from someone in the U.S. remains a convoluted and frustrating process.

The Challenges of U.S. Banking

Opening a U.S. bank account is a major hurdle unless you can physically visit a branch. Despite the emergence of numerous fintech companies in Silicon Valley, none have effectively solved this problem. I’ve tried to open accounts with various "Silicon Valley" style banks, but the process remains inaccessible without being present in the U.S. Global fintech solutions like Wise or Airwallex do offer some respite by enabling accounts in different countries, but these are not full-fledged bank accounts and still depend on traditional account-to-account connections. They are adequate for one-off transactions, payroll, or sending a gift to family, but they fall short for regular banking needs.

Navigating U.S. Payment Services

In the U.S., I rely on a combination of services such as Zelle and Wise. Zelle works well if you and your sender or recipient both bank with one of its member institutions like Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, or Wells Fargo (inc. 2,000 participating banks and credit unions). However, receiving money from another third-party institution can be a nightmare. This often leaves options like Venmo or PayPal, each with its own set of limitations. Venmo operates within a closed ecosystem, making it cumbersome to use for external transactions and you can't use Venmo outside of the US. PayPal's fees are also exorbitant and make bank-to-bank wire transfers seem more appealing.

Moreover, these platforms often treat users with excessive suspicion, subjecting transactions to frequent scrutiny as if everyone is a potential fraudster. This level of distrust can be particularly frustrating when you are just trying to send money to family or pay for goods and services.

Outside of Wise, I've always been guilty before being proven innocent - even with passports and a social security card. Recently, I had to go so far as an online notary which by the way, was not domiciled in the US or Australia.

Why isn't ACH like BECS in Australia? Why must an ACH transaction take "a week" from one bank to another? Moving funds must be near instantaneous, especially domestically.

Why is Account-to-Account Payment So Difficult in the U.S.?

The U.S. has historically been a leader in fintech innovation, yet its domestic payment systems lag behind those of countries like Australia. Several factors contribute to this paradox:

- Fragmented Banking System: The U.S. banking system is highly fragmented, with thousands of banks and credit unions, each with its own systems and protocols. This makes it difficult to implement a unified real-time payments network.

- Legacy Infrastructure: Many U.S. banks still rely on outdated legacy systems that are not designed for real-time transactions. Upgrading these systems is a costly and time-consuming process.

- Regulatory Hurdles: U.S. financial regulations can be stringent, with significant compliance requirements that can slow down the adoption of new technologies.

- Market Competition: Unlike Australia’s relatively centralized banking system, the U.S. market is highly competitive, with various players vying for dominance. This competition can hinder collaboration on a unified payments solution.

Potential Solutions

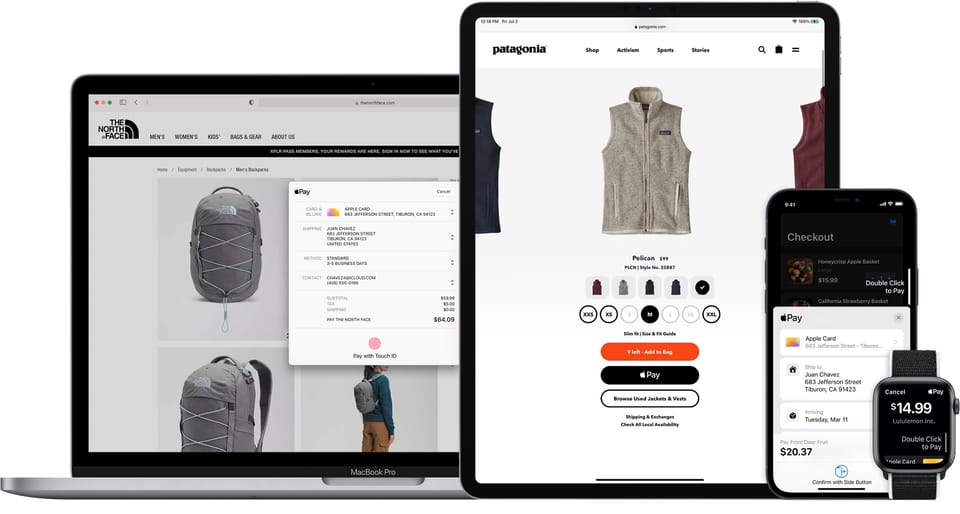

The most viable solution might be one spearheaded by global networks such as Visa or Mastercard. These companies have the infrastructure and reach to create a seamless, global payment solution between banks. They could leverage their networks to facilitate direct account-to-account payments, bypassing the limitations of the current banking systems. Their revenue models, based on charging merchants interchange and scheme fees to acquirers, would support this transition. Additionally, digital wallets like Click to Pay could further streamline the process.

However, in the short term, we need a more straightforward way to send money to and from the U.S. without resorting to multiple intermediaries. It shouldn’t be necessary to navigate a labyrinth of services and fees just to complete a simple transaction.

Living in Australia has shown me how efficient and user-friendly a payment system can be. The ease of transferring money here contrasts sharply with the cumbersome process in the U.S. While fintech innovation continues to grow, significant strides are needed to simplify account-to-account payments in the U.S. It's time for the U.S. banking system to catch up and offer the seamless, real-time transactions that are already standard in other parts of the world. Until then, sending money back home will remain a complicated endeavor - noting the missing "u" for Aussies.

About Mike Fowler

Mike is a payments and merchant acquiring veteran, senior leader & growth strategist for some of Australia's best known brands. Technical Transaction Specialist, Corporate & Institutional at National Australia Bank (NAB). Formerly at Afterpay as Director, Merchant Services APAC. With a long career in eCommerce retail as General Manager and founder of the growth team at Mosaic Brands (Noni B Group) developing and launching 9 iconic multi-category online marketplaces, including: Noni B, Rockmans, Millers, and Rivers. Member of the Australia Post Customer Advisory Group with more than 15 years experience in helping retailers leverage eCommerce, CX, payments, & logistics opportunities to maximise growth.